Contents:

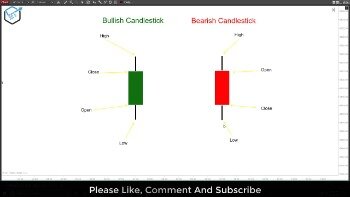

BandWidth measures the percentage difference between the upper band and the lower band. BandWidth decreases as Bollinger Bands narrow and increases as Bollinger Bands widen. Because Bollinger Bands are based on the standard deviation, falling BandWidth reflects decreasing volatility and rising BandWidth reflects increasing volatility. When the bands are relatively far apart, that is often a sign that the current trend may be ending. When the distance between the two bands is relatively narrow that is often a sign that a market or security may be about to initiate a pronounced move in either direction.

Bars closing outside the bands are statistically more likely to indicate the continuation of the trend, rather than its end. Here you can set up filters by technical and fundamental parameters. The installation principle for this instrument is the same as for Bollinger Bands %b. Copy the unarchived Bollinger_Bands_3b.mq4 file to this directory and restart the terminal. For example, the level, upon crossing which you need to buy, etc. Colors – here you can set up the color, thickness and look of the indicator lines.

If such a need arises, you need to change the timeframe, for example, switch from a daily to a four-hour chart or vice versa. In the initial stages, I recommend limiting yourself to a period of bars. The author himself believes that his indicator works best in this range. Bollinger Bands Width technical indicator is derived from Bollinger Bands. Non-normalized Bollinger Bands Width measures the distance or difference, between the upper band and the lower band.

Bollinger BandWidth

In the trading process, we will need to determine the levels 0.95 and 0.05. For convenience, in the «Levels» tab, add a new value «0». The third indicator will be the Bollinger Bands %b, which is already familiar to us from the previous strategy. I have already described its installation and setting up.

If you’re looking to go long when trading a squeeze, consider placing a buy entry point above the upper band. Once it’s executed, you could place an initial stop under the low of the breakout formation or under the lower band. Remember to adjust your stop orders as needed, or consider using a trailing stop designated in either a fixed dollar amount or a fixed percentage.

Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. For example, if the upper band sits at $30 and the current price is $22.50, %b equals 0.75, putting the stock three-fourths of the way toward the upper band limit. This is helpful for traders to identify when a price jumps a band, which can determine divergences and trend changes. Donchian Channels are moving average indicators developed by Richard Donchian. They plot the highest high price and lowest low price of a security over a given time period. Many technical indicators work best in conjunction with other ones.

Stochastic Oscillator: Guide for Using Indicator & Best Settings

If it lengthens or https://trading-market.org/ens, the number of standard deviations should also be increased or decreased. For example, for fifty periods it is better to use a ratio of 2.1, and for 10 periods – 1.9. For example, a chart might contain two band indicators plotted using the same calculation period but with different ratios. In his book, the analyst gives an example of a chart with two volatility bands in 20 periods that differ in width by 1 and 2 standard deviations.

Keep a long position as long as the candles close within it. Visually, these two technical indicators coincide at the moving average line but have different widths. A narrower channel is built with a factor of 1.0, and a wider one – with a factor of 2.0.

Donchian Channels Formula, Calculations, and Uses – Investopedia

Donchian Channels Formula, Calculations, and Uses.

Posted: Sat, 25 Mar 2017 19:38:38 GMT [source]

To profit on this setup, you can buy futures contracts or an ETF that mirrors the broad market. To determine your potential profit potential, review prior rallies to determine the mean. In all the three instances price fell 5.6%, 3.6% and 7.6% from the short term market tops when the indicator dipped below 2%. As a trader, you can zoom out on your chart to get a sense of the volatility within context to prior moves. The descriptions, formulas, and parameters shown below apply to both Interactive Charts and Snapshot Charts, unless noted.

Bollinger Bands Indicator in Forex Strategies

Their use for additional confirmation of price action behavior is meaningless. In the chart, the blue middle band channel represents standard bands based on a 20-period moving average. The orange channel, in turn, was built on the basis of the 20-period EMA.

Funnily enough, at first John Bollinger did not even think about trading. But while working as an operator at one of the Hollywood companies, he encountered some financial analysts and became interested in this occupation. Later, the future trader’s mother asked her son to help organize her investment portfolio. Schwab does not recommend the use of technical analysis as a sole means of investment research. Bollinger bands have been applied to manufacturing data to detect defects in patterned fabrics.

Another method would be to use the parabolic SAR indicator to trail your stop. Finally, to capture longer moves, you could consider exiting when the stock tags the opposite band (i.e., the lower band if you’re long, or the upper band if you’re short). Bollinger Bands can also indicate the end of a strong trend. Strong trends, especially those developing after a breakout of a trading range, will result in an expansion in volatility that will cause the bands to initially move apart. This means that in a strong uptrend, the lower band will actually move downward in the opposite direction of the new trend.

Final Remarks on Bollinger Band Width in Systematic Trading

Some of the most common indicators used by traders are BandWidth, %b, and BBTrend, all of which were created by John Bollinger. Bollinger Bands® is not a standalone trading system but just one indicator designed to provide traders with information regarding price volatility. Some of his favored technical techniques are moving average divergence/convergence , on-balance volume, and relative strength index . The well-known trading analyst Wilfrid LeDoux used a trading channel based on two moving averages as technical indicators in his trading system.

Please note that the BandWidth is at its lowest during this period. The signal for an early entry into the market is the narrowing of the BB. We will identify it using BandWidth, which demonstrates its lowest values during this period. If you are going to use this strategy on small timeframes, I recommend to monitor more stable trends additionally. This way you will avoid entering the market against powerful trends.

As John Bollinger argued, periods of low market activity are cyclically replaced by periods of high volatility where the bands widen. This statement is the essence of the Bollinger Squeeze strategy. In our graph above, only one condition is met strictly.

The Complete Guide to Volatility Indicators – Yahoo Finance

The Complete Guide to Volatility Indicators.

Posted: Sun, 23 May 2021 07:00:00 GMT [source]

If you look closely at this formula, you will understand that if the last price is located on the upper Bollinger bands, the calculation result will be 1. If it is located on the moving average, the %b value will be 0.5. And if the price falls and stops at the lower bands, the result of the above formula will be 0. The second high can be higher or lower than the first high.

The main purpose of BB indicator is to determine a sharp deviation from the average direction of the current trend. A squeeze occurs when the two bands tighten in space, that is, a decrease in the width of the band, making it narrow. On the other hand, it also indicates that a period of high volatility is approaching. Bollinger Bands refers to a technical analysis tool focusing on security price and volatility to disclose overbought and oversold points.

Almost all trading systems use Bollinger Bands in conjunction with the readings of other indicators. These can be both classic RSI, MACD, Average True Range , as well as more complex volume indicators or entire trading systems. The only condition is that there is no connection between the calculation of the Bollinger Bands and additional indicators. Place the stop loss at the extreme reversal point, and in the process of the new trend development, move it to the breakeven zone.

bollinger bands bandwidth Band Width is derived from Bollinger Bands and measures the percent difference between the upper and lower bands. It decreases as Bollinger Bands narrow and increases as Bollinger Bands widen. Because Bollinger Bands are based on the standard deviation, falling Band Width reflects decreasing volatility and rising Band Width reflects increasing volatility. A good example of a double-top pattern is shown in the chart below. As you can see, the BTC/USD pair formed a double-top at 44,891 and a chin at 41,460. At the time, the Bollinger Bandwidth was at a narrow range.

The period of the fast EMA should be set at 21 bars, the slow one at 100 candles, and the signal line – at 9. First of all, we need a Bollinger indicator with standard settings. I’ve described earlier how to add it to the MT4/MT5 chart.

The parameters are standard – the period of the middle band of the moving average of 20 bars and two standard deviations. Between 1984 and 1991, John worked on his own trading system based on the LeDoux strategy and the envelope indicator. John’s brainchild was named after its creator – the Bollinger Bands. This technical analysis tool developed was based on a middle band known as the moving average with so-called volatility bands plotted above and below. However, unlike envelopes, the offset is not by a certain number of points, but by a percentage.

- The next move will be a second touch inside the lower Bollinger Band.

- What needs to be understood however is that a trader cannot simply look at the BBW value and determine if the Band is truly narrow or not.

- In the process of the market movement along the trend, the stop order should be moved to a break-even position.

Bollinger Bands work on any timeframe and any market conditions. An important requirement for the correct use of the indicator is sufficient price activity and calibration of the parameter settings based on the history of its movement. This strategy aims to predict trend reversals by comparing the touch of the Bollinger Bands with the behavior of indicators.

The Bollinger Bands indicator is among the best indicators for tracking and predicting future impulses. Rooney, technical analyst and trader with ten years of experience, winner of an award in writing trading systems. The Bollinger Bounce strategy involves trading on developing trends. In an uptrend, we will look for the moment when the price action rolls back down, touches or almost touches the lower band. In a downtrend, on the contrary, we need a moment when several candles go up and stop at the border of the upper band and identify the m tops.